Getting The Frost Pllc To Work

Getting The Frost Pllc To Work

Blog Article

Unknown Facts About Frost Pllc

Table of ContentsFrost Pllc for DummiesThe 10-Second Trick For Frost PllcSome Known Questions About Frost Pllc.Frost Pllc Fundamentals ExplainedFrost Pllc Things To Know Before You Get This9 Easy Facts About Frost Pllc Explained10 Easy Facts About Frost Pllc Described

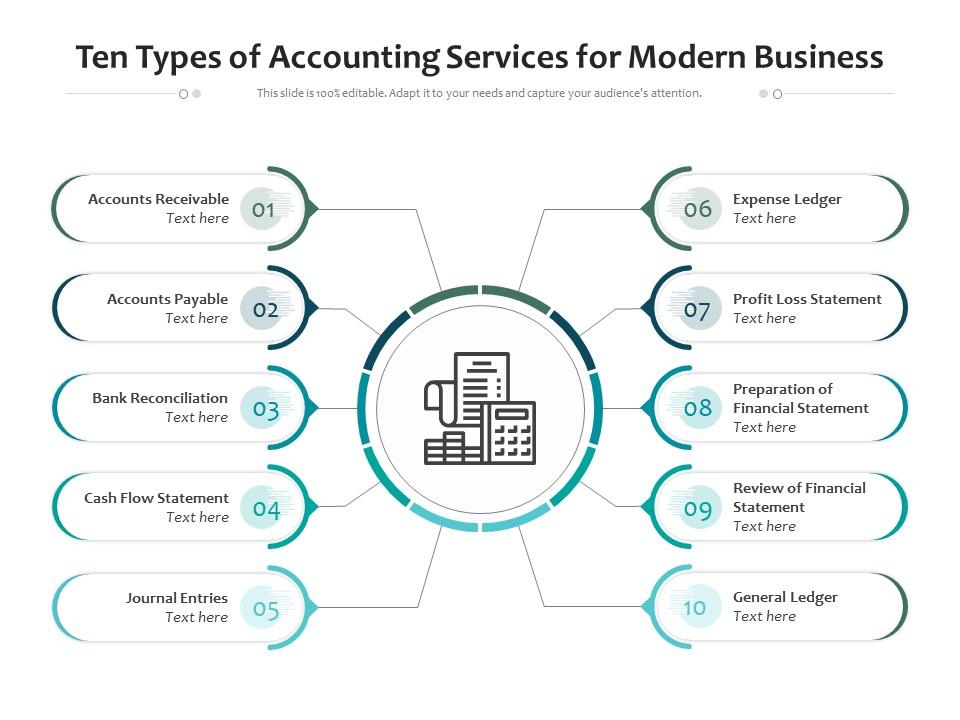

Government bookkeeping includes audit solutions for government entities. They accountant record and assess the company economic information and use the details to aid in budgeting, expense administration, property management, and efficiency examination.They inspect if the company is functioning by the law and policy. Accounting audit7. Payroll processingThis type of bookkeeping solution entails keeping records of the financial accounts of the service.

The accountant keeps an eye on the payment of the accounts and how they are received. This manages income tax and various other tax obligations that are positioned on the business. The tax accountant makes certain that they provide the very best advice when it pertains to cases and shields the company from paying unnecessary tax obligations.

About Frost Pllc

They guarantee efficient and exact accountancy work. Auditing offers comprehensive monetary information about the organization. The auditors are entailed validating and guaranteeing the accuracy of economic statements and reports.

This solution makes sure accurate bookkeeping of financial documents and assists to discover any kind of discrepancy.the accountants help in giving the organization minimize expenses and safeguard scams. This service ensures precision in tax rates and regulative info. It provides the maintenance of financial documents of staff member's earnings, deductions, and benefits.

Bookkeeping solutions need to follow the laws and guidelines of the company in addition to those of the state.

Some Ideas on Frost Pllc You Should Know

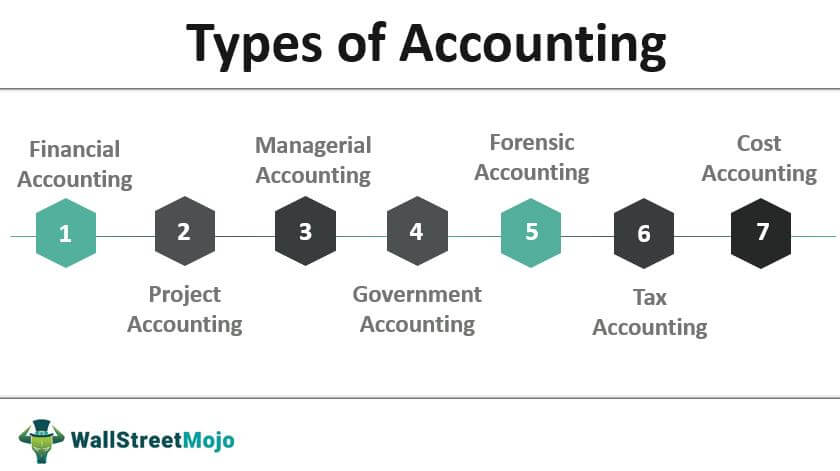

If you have a head for numbers and a heart for helping companies run with precision, becoming an accountant can add up to a pleasing and worthwhile career. Extensively talking, accountants are experts that evaluate and report on financial purchases for people or companies. There are many sorts of accounting professionals, spanning all kind of markets consisting of the public industry, nonprofits, private sector, and regional, state, and federal government.

Let's dive in and see which kind of task in this market rate of interests you the most! Financial accounting is one of the most identifiable types of accounting professionals, who are normally accountable for preparing monetary declarations for their customers.

Fascination About Frost Pllc

Certified public accountants are one of the types of accountants that are virtually universally required and essential for an effective company. As its family member stability no issue what the economic climate, taxes must be filed.

CPAs are certified company website and may have various other qualifications. Tax obligation accountants are responsible for assisting customers deal with a variety of tax-related needs outside of filing quarterly or annual tax obligations, including aiding with audit conflicts, licensure, and more. Credit score managers help determine whether a company or person can open up or extend a credit line or a lending.

How Frost Pllc can Save You Time, Stress, and Money.

Debt managers can additionally function internally to help a business gather payments, problem credit reports or car loans, and examine the firm's financial risk. By setting a company's budget plan, cost accounting professionals aid overview decision-making and investing control. This function resembles many of the various other sorts of accountants formerly pointed out, in that they have several responsibilities when it concerns numbers: bookkeeping, reporting, examining, and more.

Customer Accounting Provider (CAS or CAAS) describes a variety of conformity and advisory solutions an audit company offers see post to a company customer. Essentially, the accounting firm works as an outsourced money department for the client. Company owners are proactively seeking methods to attain more growth with much less work, time, and labor force.

You'll also find CAS referred to as CAAS, Customer Accounting Advisory Services, or Customer Advisory Services. Below are some of the essential rates of CAS: Accounting is a fundamental tier of CAS.By helping clients with the everyday recording of economic deals, you develop the structure blocks of their financial documents, help in compliance, and supply the essential data for calculated decision-making.

Consists of incoming payments, billing development, tracking payments due, taking care of collections, and making sure that the client's cash money circulation is consistent and predictable. Guarantees that all service deals are accurately recorded, guaranteeing the honesty of financial information. Frost PLLC.

The Definitive Guide to Frost Pllc

Audits and tax obligation preparation are traditional services, yet they stay essential to comprehensive CAS offerings. Audits include examining a business's economic declarations and records to guarantee precision and conformity with accounting requirements and guidelines. In addition, tax prep work involves compiling and submitting tax returns, guaranteeing precision to prevent charges, and recommending on tax-efficient approaches.

Traditionally, billing by the hour has been the go-to method in bookkeeping. This version is ending up being significantly out-of-date in today's bookkeeping landscape.

It's comparable to a fixed-priced version because you bill in a different way relying on the solution, however it's not a one-size-fits-all approach. It involves private conversations with your customers to determine what their priorities are, what solutions they need, exactly how commonly, and the scope of the jobs. From there, you can weigh up every one of these variables and offer them a quote that accurately shows the effort, time, and job called for to meet their requirements.

The 4-Minute Rule for Frost Pllc

It's a costs design: a costs level of solution and a costs expense. You may charge a customer $7,500 per month, which includes all the solutions you use.

Report this page